Second time buyer mortgage calculator

Comparing low-downpayment-mortgage options is at the heart of this. Camera pans right to a split screen with a yellow background on the left and a picture of high-rises on the right.

Can I Afford To Buy A Home Mortgage Affordability Calculator

The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be.

. We want to help with a 2000 Bonus Interest less DIRT on your savings when you draw down your Bank of Ireland mortgage. The minimum amount you would have to contribute is a 5 mortgage deposit so a 95 loan-to-value mortgage although this minimum may differ depending on what type of mortgage you are looking for. Discount points may be paid by either the buyer or seller.

You have to be a first-time home buyer earn 80000 a year or less annually and you cant be a current shared home owner. Five year fixed rate for existing customers of 300. Accessibility statement Accesskey 0 Skip to Content Accesskey S.

You can use our mortgage interest rate calculator to work out how much interest you might pay. Mortgage repayment calculator. How to use HSHs FHA mortgage calculator.

Homebuyers tend to pay a deposit of at least 10 to reduce their mortgage rate. As a first time buyer the highest level of mortgage facilities you can get is 90 of the purchase price ie. Press the report button for a full amortization schedule either by year or by month.

A second home is typically defined as a home you would live in for some part of the year. Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage. The criteria differ for each category.

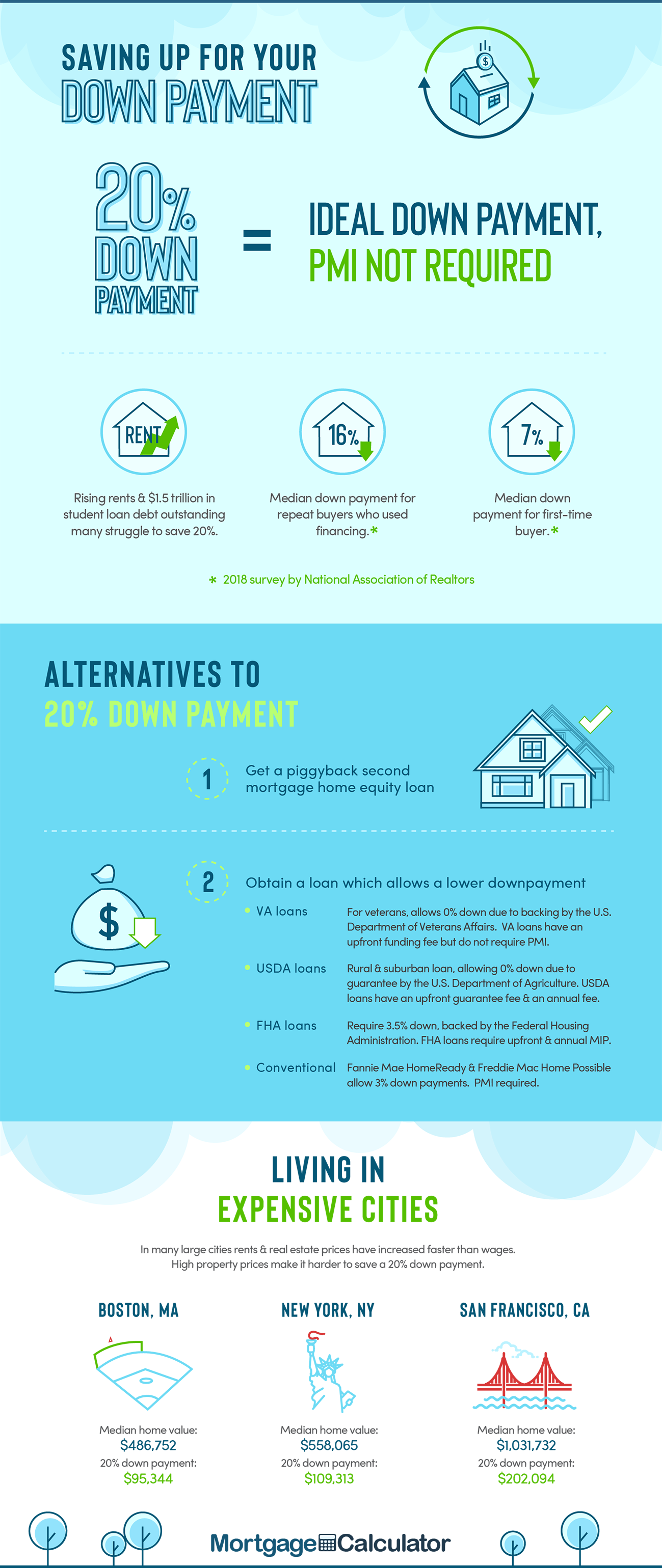

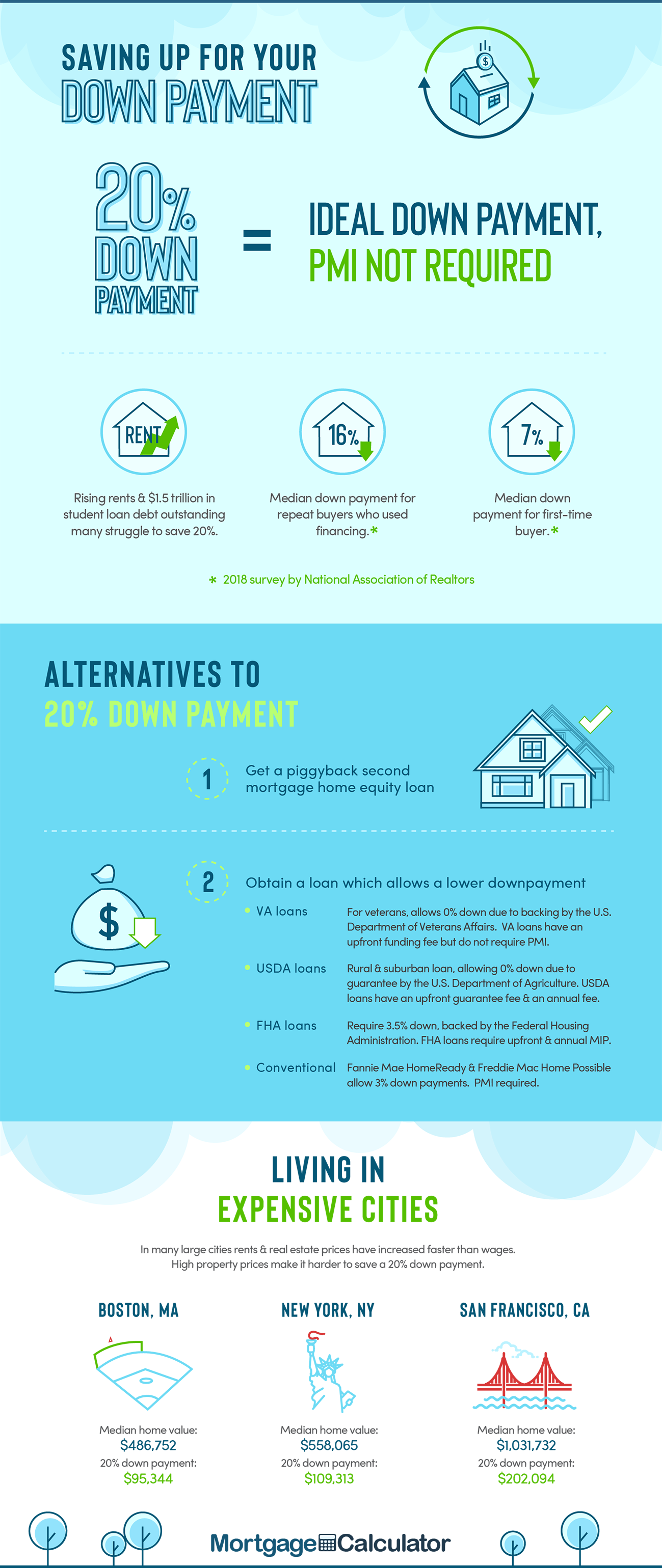

The State of New York Mortgage Agency gives first-time home buyers access to low-interest and low-down-payment mortgages in addition to down payment assistance programs. Our calculator and low down-payment comparator enable you to compare these offerings on a side-by-side basis. If youre a firsttime home buyer in Delaware with a 20 down payment you can get a conventional loan with a low interest rate.

Applicants must be aged 18 or over. Youll learn exactly how each of these choices could affect your housing costs during the time you expect to own your home. Quickly see how much interest you will pay and your principal balances.

How much do you think youll be able to borrow from the bank. Second and Subsequent Use. You can even determine the impact of any principal prepayments.

After year three a Managed Variable Rate 80-90 LTV of 39 APRC 397 applies however there are also Fixed Rate options that would be available as an alternative to this Managed Variable Rate eg. If you want to compare more than two mortgage loans use our amortization calculator where you can compare up to four loans side-by-side compare prepayment scenarios and more. Or less is considered to be reasonable.

This can be combined with a few different down payment assistance programs including The Florida Assist 7500 0 percent deferred second mortgage. MortgageSaver provided by Bank of Ireland. Security and home and life insurance are required.

Repayments are based on a three year fixed rate of 295 APRC 371. Whether youre a first-time buyer home mover or youre remortgaging you can calculate your estimated monthly repayments with our mortgage repayment calculator. For instance if the property is priced at 260000 your deposit should be 13000.

A young man looking at his phone while sitting on the floor surrounded by moving boxes. Certain flexible mortgage repayment options can only be used one at a time and may result in additional interest costs over the term of the loan. A variable-rate mortgage can change month to month so you wont always pay the same amount.

And you never have to pay for private mortgage insurance PMI. If youre a first-time home buyer in Virginia with a 20 down payment you can get a conventional loan with a low interest rate. Credit ReportThis fee is paid to credit agencies to evaluate the credit history of a.

A fixed-rate mortgage means your interest rate will stay the same for the term of the deal. Available for first time buyers only who draw down a mortgage with us within 30 months of MortgageSaver account opening. This is calculated at purchase price 300000 multiplied by 90 270000 Therefore you need 30000 for your 10 deposit plus money for stamp duty and legal fees approximately 3000 for stamp duty and 2000 for legal fees in total 35000.

Maximum loan to value is 90. The Government of Canada launched The First-Time Home Buyer Incentive Visual. First-Time Home Buyer Incentive.

Ask us about our First Time Buyer MortgageSaver Bonus. Important information assumptions. As part of calculating your mortgage we will ask how much money you have to put towards the deposit for your mortgage.

Your second loan will calculate and youll be able to see monthly payments total interest payments and more in a side-by-side display. Sutton is the second quickest moving market with homes being on the market for an average of 28 days before an offer is made. One very important thing to note is that a property cannot be listed as your primary residence and your second home at the same time.

Rates available to new and existing home mortgage customers only. Thinking about getting onto the housing ladder. If you had a 10 mortgage deposit and were purchasing.

However mortgages that allow a high LTV typically offer higher mortgage rates. Note that first-time buyer mortgages allow a loan-to-value ratio LTV of 95. Buying A Second Home That Will Be Your Primary Residence.

Our free 55-page First-Time Buyers Guide talks you through everything you need to know from deposits to different types of mortgages and ways to boost your chances of mortgage acceptance. Free VA mortgage calculator to find the monthly payment total interest. And you never have to pay for private mortgage insurance PMI.

Second Home Mortgage Calculator Vacation Property Online

Real Estate Guide Home Mortgage Mortgage Home Buying

Downloadable Free Mortgage Calculator Tool

87 Real Estate Infographics How To Make Your Own Go Viral The Close Home Ownership Real Estate Infographic Down Payment

Buying A House First Time Buyer Mortgage Infographic Home Buying Mortgage Marketing

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Home Buying Process Buying First Home Home Buying Tips

Mortgage Calculator With Down Payment Dates And Points

Home Loan Downpayment Calculator

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Tumblr Buying First Home Mortgage Checklist Buying Your First Home

Cash Out Refinance Calculator Freeandclear Mortgage Amortization Calculator Mortgage Refinance Calculator Refinance Calculator

Downloadable Free Mortgage Calculator Tool

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Mortgage Calculator Amortization Schedule Mortgage Rates

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Loan Originator Mortgage Infographic

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide